Policy Management

Create, renew, and manage custom insurance policies and contract types

Discover who we are, what we stand for, and how we bring value to our clients worldwide.

Explore our company’s history, milestones, and growth story.

Learn about the core principles that guide everything we do.

See how we foster an inclusive workplace and celebrate diverse perspectives.

Meet the people driving our vision and success.

Understand our commitment to ESG goals aligned with global sustainability targets.

Access detailed reports on our sustainability efforts and progress.

Learn about our initiatives to give back and support local and global communities.

Read real examples of how our work positively affects clients and communities.

See the advanced tools and platforms we use to deliver cutting-edge results.

Explore the sectors we specialize in and how we tailor solutions for each.

Explore the sectors we specialize in and how we tailor solutions for each.

Discover the trusted alliances and collaborations that strengthen our solutions.

Find out about opportunities to join our team and grow with us.

Hear from clients and partners about their experiences working with us.

Learn about the credentials and recognitions that validate our expertise.

Understand the flexible ways we engage and deliver projects to meet your needs.

Access brochures, guides, and other helpful materials.

Find answers to common questions about our services and processes.

Build scalable, high-performance web applications tailored to your business goals.

Design native or cross-platform apps for iOS and Android.

Develop software tailored to complex business needs.

Seamless platform connections.

Automate and streamline deployment workflows.

Create engaging 2D/3D games for mobile, web, or console platforms.

Custom themes and plugins, WooCommerce store setup and optimization.

Design and develop Shopify e-commerce stores tailored to your brand.

Implement and manage CMS platforms for flexible content delivery.

Launch branded platforms quickly with pre-built customizable solutions.

Automate repetitive workflows across business operations.

Connect and control devices with custom IoT platforms and edge computing.

Build secure decentralized apps (dApps), tokens, and smart contracts.

Implement machine learning models, AI assistants, vision, and NLP applications.

Simulate and optimize systems in real time.

Create immersive experiences for training, retail, or simulation.

Integrate IoT, automation, and analytics for Industry 4.0 readiness.

Implement or customize CRMs like HubSpot, Zoho, or Dynamics to streamline customer relationships.

Tailor Salesforce CRM with custom modules, automations, and dashboards.

Enhance or extend SAP systems for better performance and integration.

Automate factory operations with custom MES, ERP, or control systems.

Tailored enterprise resource planning systems.

Seamlessly move legacy systems to AWS, Azure, or Google Cloud.

Evaluate and optimize your cloud based on security, cost, and scalability.

Analyze and reduce cloud spending efficiently.

Tech, design, and advisory support from MVP to product launch.

24/7 support for employees or clients.

Ongoing monitoring, security, and maintenance of your IT infrastructure.

Maintain system reliability, scalability, and performance with proactive monitoring and automation.

Manual and automated testing for performance, functionality, and usability.

Protect your systems with audits, firewalls, and compliance measures.

Gather insights from real users to guide design decisions and product direction.

Visualize layouts and user flows with wireframes and test ideas through prototypes.

Craft clean, responsive interfaces that enhance usability and user satisfaction.

Identify pain points and improve UX through real-user interaction testing.

Build consistent, scalable UI systems with reusable components and clear rules.

Review and improve existing UI/UX for better clarity and consistency.

Insurance And Legal

Insurance And LegalDiscover who we are, what we stand for, and how we bring value to our clients worldwide.

Explore our company’s history, milestones, and growth story.

Learn about the core principles that guide everything we do.

See how we foster an inclusive workplace and celebrate diverse perspectives.

Meet the people driving our vision and success.

Understand our commitment to ESG goals aligned with global sustainability targets.

Access detailed reports on our sustainability efforts and progress.

Learn about our initiatives to give back and support local and global communities.

Read real examples of how our work positively affects clients and communities.

See the advanced tools and platforms we use to deliver cutting-edge results.

Explore the sectors we specialize in and how we tailor solutions for each.

Explore the sectors we specialize in and how we tailor solutions for each.

Discover the trusted alliances and collaborations that strengthen our solutions.

Find out about opportunities to join our team and grow with us.

Hear from clients and partners about their experiences working with us.

Learn about the credentials and recognitions that validate our expertise.

Understand the flexible ways we engage and deliver projects to meet your needs.

Access brochures, guides, and other helpful materials.

Find answers to common questions about our services and processes.

Build scalable, high-performance web applications tailored to your business goals.

Design native or cross-platform apps for iOS and Android.

Develop software tailored to complex business needs.

Seamless platform connections.

Automate and streamline deployment workflows.

Create engaging 2D/3D games for mobile, web, or console platforms.

Custom themes and plugins, WooCommerce store setup and optimization.

Design and develop Shopify e-commerce stores tailored to your brand.

Implement and manage CMS platforms for flexible content delivery.

Launch branded platforms quickly with pre-built customizable solutions.

Automate repetitive workflows across business operations.

Connect and control devices with custom IoT platforms and edge computing.

Build secure decentralized apps (dApps), tokens, and smart contracts.

Implement machine learning models, AI assistants, vision, and NLP applications.

Simulate and optimize systems in real time.

Create immersive experiences for training, retail, or simulation.

Integrate IoT, automation, and analytics for Industry 4.0 readiness.

Implement or customize CRMs like HubSpot, Zoho, or Dynamics to streamline customer relationships.

Tailor Salesforce CRM with custom modules, automations, and dashboards.

Enhance or extend SAP systems for better performance and integration.

Automate factory operations with custom MES, ERP, or control systems.

Tailored enterprise resource planning systems.

Seamlessly move legacy systems to AWS, Azure, or Google Cloud.

Evaluate and optimize your cloud based on security, cost, and scalability.

Analyze and reduce cloud spending efficiently.

Tech, design, and advisory support from MVP to product launch.

24/7 support for employees or clients.

Ongoing monitoring, security, and maintenance of your IT infrastructure.

Maintain system reliability, scalability, and performance with proactive monitoring and automation.

Manual and automated testing for performance, functionality, and usability.

Protect your systems with audits, firewalls, and compliance measures.

Gather insights from real users to guide design decisions and product direction.

Visualize layouts and user flows with wireframes and test ideas through prototypes.

Craft clean, responsive interfaces that enhance usability and user satisfaction.

Identify pain points and improve UX through real-user interaction testing.

Build consistent, scalable UI systems with reusable components and clear rules.

Review and improve existing UI/UX for better clarity and consistency.

Insurance And Legal

Insurance And LegalA unified platform for managing policies, claims, compliance, risk, and reinsurance with clarity and automation.

The Insurance Management System is built to streamline, digitize, and unify all essential insurance workflows. Whether it’s automating policy entries, managing claim submissions, or tracking renewals and compliance statuses, this module offers a reliable, real-time solution for every stage of the insurance lifecycle.

Its main purpose is to:

Insurance operations often struggle with fragmented policy handling, slow claims processing, manual compliance tracking, and inconsistent communication across teams and clients. This system eliminates those bottlenecks by unifying policy lifecycle management, automated renewals, risk assessment, reinsurance coordination, and regulatory monitoring into one intelligent platform. With integrated analytics, streamlined workflows, and real-time alerts, insurers can reduce errors, improve operational speed, strengthen compliance, and deliver a more transparent experience for clients, auditors, and partners.

Each functional component of the system is modular and scalable for easy customization.

A unified set of tools that streamlines policies, claims, payments, risk checks, compliance, and communication, all in one efficient workflow.

Manage policy creation, updates, and renewals in a centralized workflow that reduces manual effort and eliminates repetitive tasks. Automated reminders, pricing rules, and document generation ensure every policy stays accurate, timely, and fully aligned with organizational standards.

Key Capabilities:

Digitally evaluate client risk profiles with structured questionnaires and historical data that feed directly into underwriting decisions. This helps teams make consistent, data-driven judgments while maintaining a complete record of all assessment activities.

Key Capabilities:

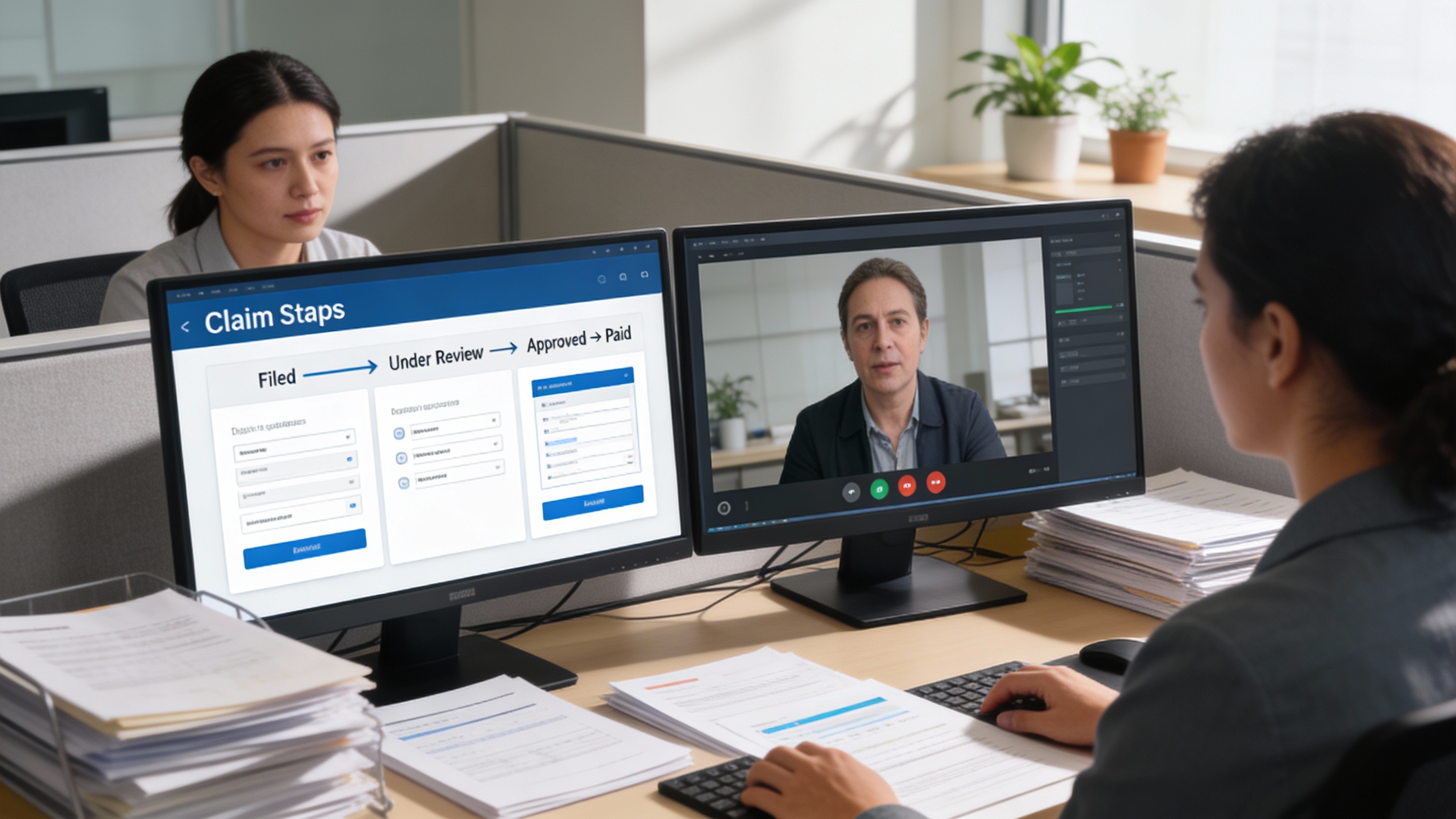

Claims can be filed, reviewed, and approved faster with guided workflows and real-time status visibility for staff and clients. Each claim maintains its documentation trail, making audits and compliance checks straightforward and transparent.

Key Capabilities:

The system manages premium reminders, invoices, and auto-renewal rules to reduce missed payments and manual follow-ups. Payment tracking and digital billing tools ensure financial clarity across all client accounts.

Key Capabilities:

Compliance documents, licenses, and regulatory files are monitored automatically with alerts before expiration or violation risks occur. Comprehensive logs and audit-ready records help organizations stay aligned with legal and industry standards.

Key Capabilities:

Automated email triggers keep clients and internal teams informed about important events such as issuance, claims, renewals, and approvals. All messages are tracked and archived, giving teams full visibility into communication history.

Key Capabilities:

Ideal for insurers, reinsurers, underwriters, and auditors who need a faster, clearer way to manage policies, risks, and claims.

Leave your email below to start a new project journey with us.

Let’s shape the future of your business together.